- RRSPs are best used to save for your retirement goals.

- RRSPs can be used to fund the downpayment of your first home or to fund post-secondary education.

- Contributions are tax deductible.

- The sooner you start contributing the better off you'll be when it comes to enjoying your retirement years.

RRSPs & RRIFs

Build and enjoy your retirement savings with special tax benefits.

Invest today, for a worry-free tomorrow

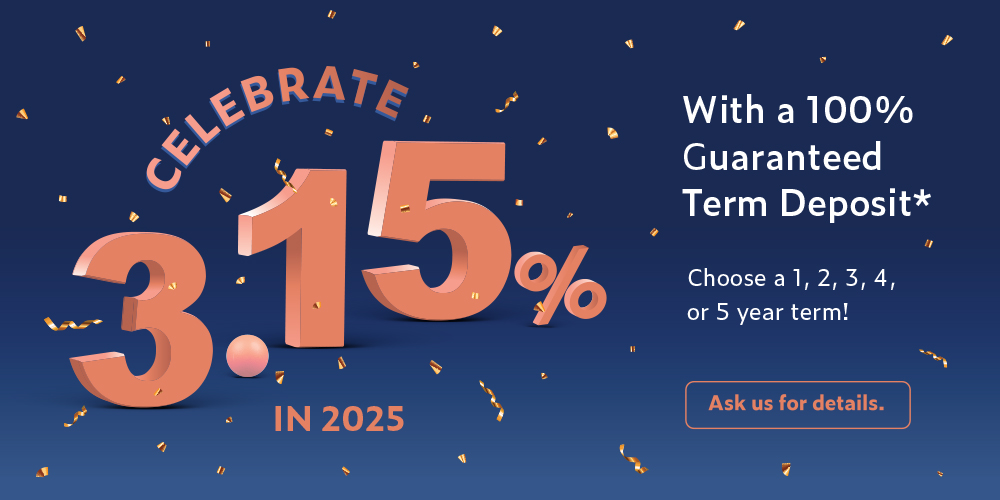

Celebrate your savings!

- Minimum investment of $500

- Choose from a 1-5 year locked in term

- Offer available until March 3, 2025

- Open to both registered and non-registered accounts

*Rates subject to change without notice. All eligible deposits are fully guaranteed by the Credit Union Deposit Insurance Corporate of British Columbia (CUDIC)

How RRSPs work

How RRIFs work

Grow your savings with investments that suit your goals

Invest with expert advice

Let our team of local experts walk you through your investment options and create a plan that suits your needs.

Select Image

Invest on your own

Prefer to manage your own investments? Qtrade Direct Investing®* makes buying, selling and rebalancing easy.

Select Image

Save more with an RRSP Loan

With our investment loans, you can maximize the benefits of tax-free growth at competitive borrowing rates.

Depositors are 100% protected

Your eligible deposits are 100% guaranteed by the Credit Union Deposit Insurance Corporation of British Columbia.

*Online brokerage services are offered through Qtrade Direct Investing. Mutual funds and other securities are offered through Aviso Wealth. Qtrade Direct Investing and Aviso Wealth are divisions of Aviso Financial Inc.Unless otherwise stated, mutual funds, other securities and cash balances are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer that insures deposits in credit unions.